avalara tax code nt

The totalTax should be 735. TaxCode the Avalara Product Tax code for the variant.

Understanding Freight Taxability Avalara Help Center

Leverage cloud-native software from a tax compliance leader.

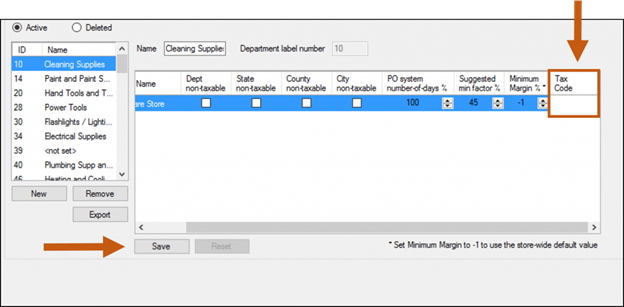

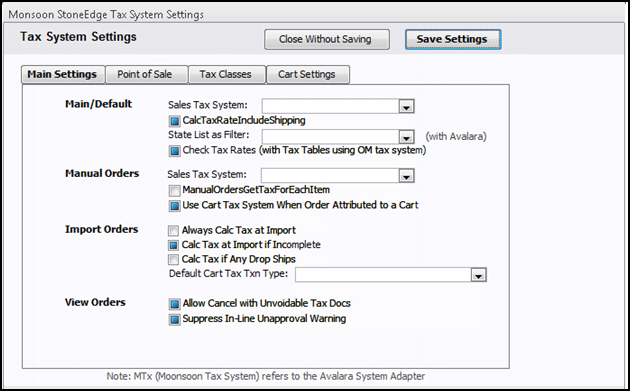

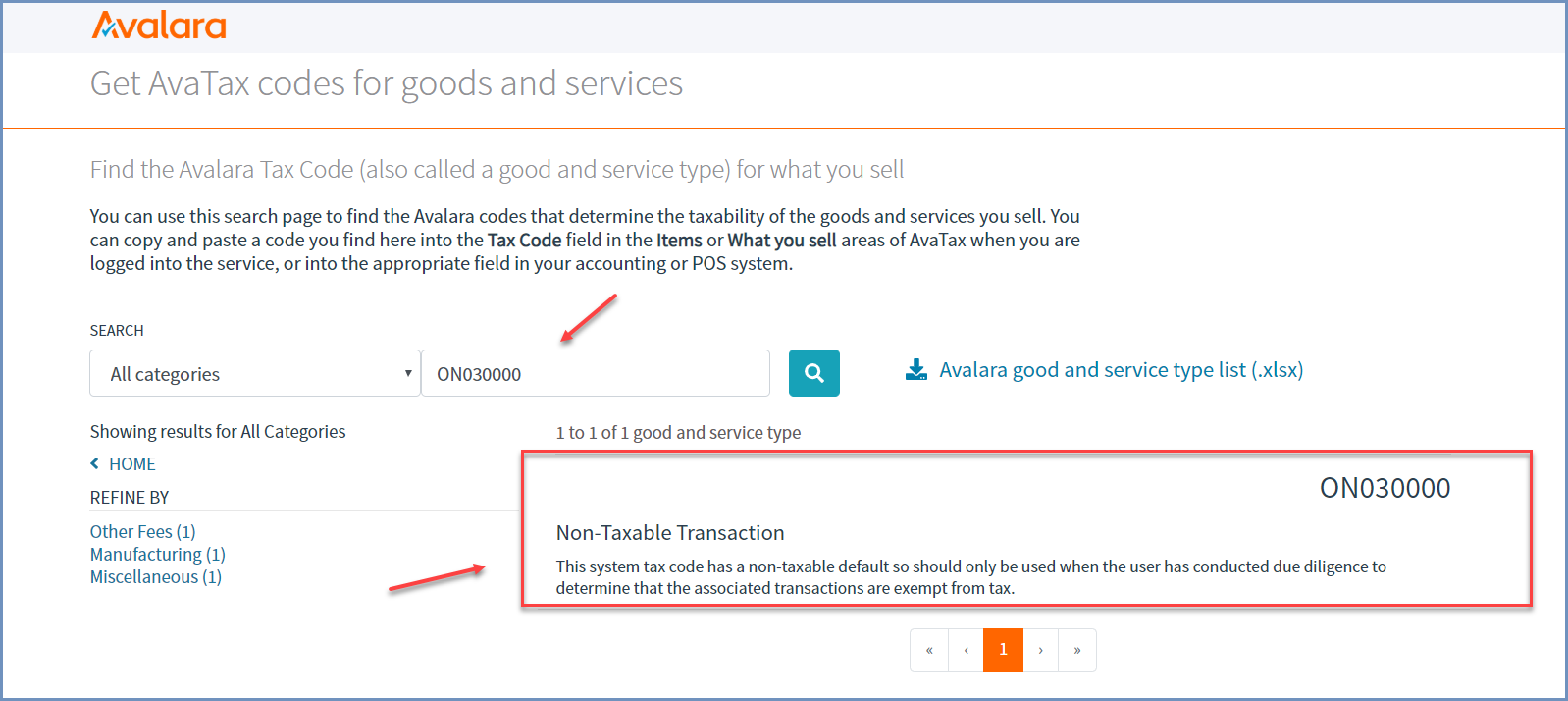

. Find the Avalara Tax Codes also called a goods and services type for what you sell. Its important to note that there is a maximum of 100000 items per import. You can use this search page to find the Avalara codes that determine the taxability of the goods and services you sell.

You can copy and paste a code you find here into the Tax Codes field in. You can use this search page to find the Avalara codes that determine the taxability of the goods and. The tax amount for Shipping should be 035.

If you must map more than 100000 SKU codes to. A reliable secure and scalable tax compliance platform. Access a database of tax content rates and rules for 190 countries.

So you can see that adding a freight charge to a transaction is no different from.

Prestashop Barcamp 5 Avalara Keeping Compliant In The Changing La

Set Up An Account Or A Product As Tax Exempt With Avatax Accounting Seed Knowledge Base

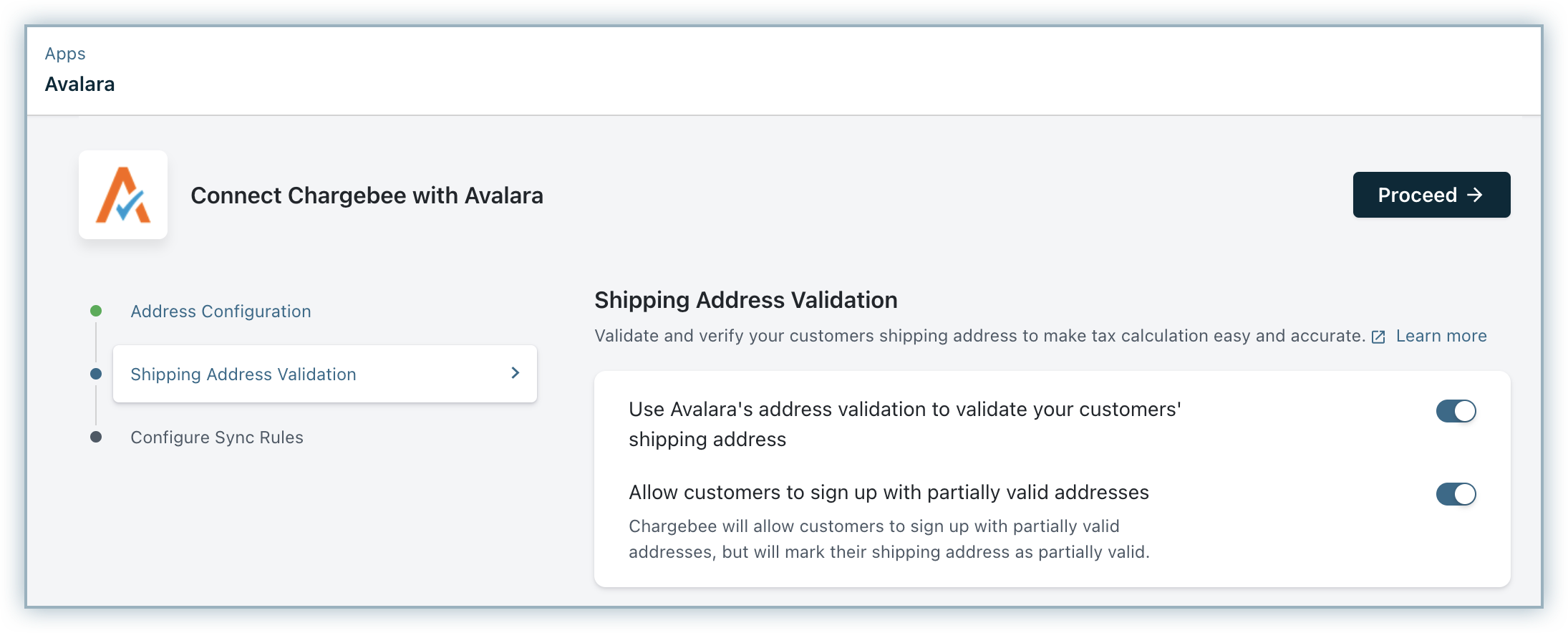

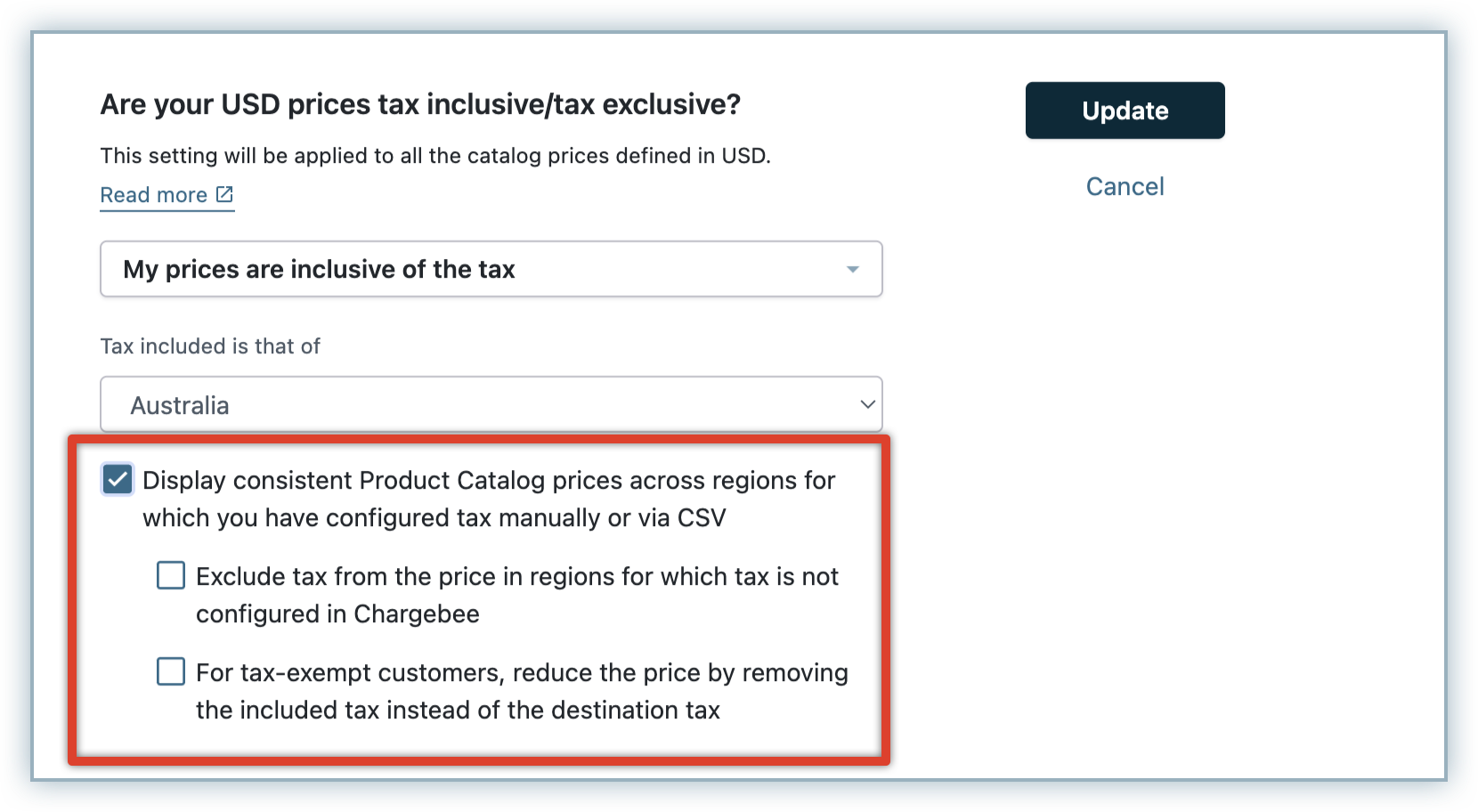

Avatax For Sales Chargebee Docs

Avalara Issue Erp 10 Epicor User Help Forum

Avatax For Sales Chargebee Docs

Avalara Application By Kibo Ecommerce

Product Business Partner And Freight Taxability With Avalara In Sap Business Bydesign Sap Blogs

Avalara Tax Code Classification And Avatax Cross Border Solutions Youtube

Create Your Avatax Tax Code Agency And Vendor Avalara Connector For Netsuite Youtube

Retail Ecommerce Sales Tax Software Avalara

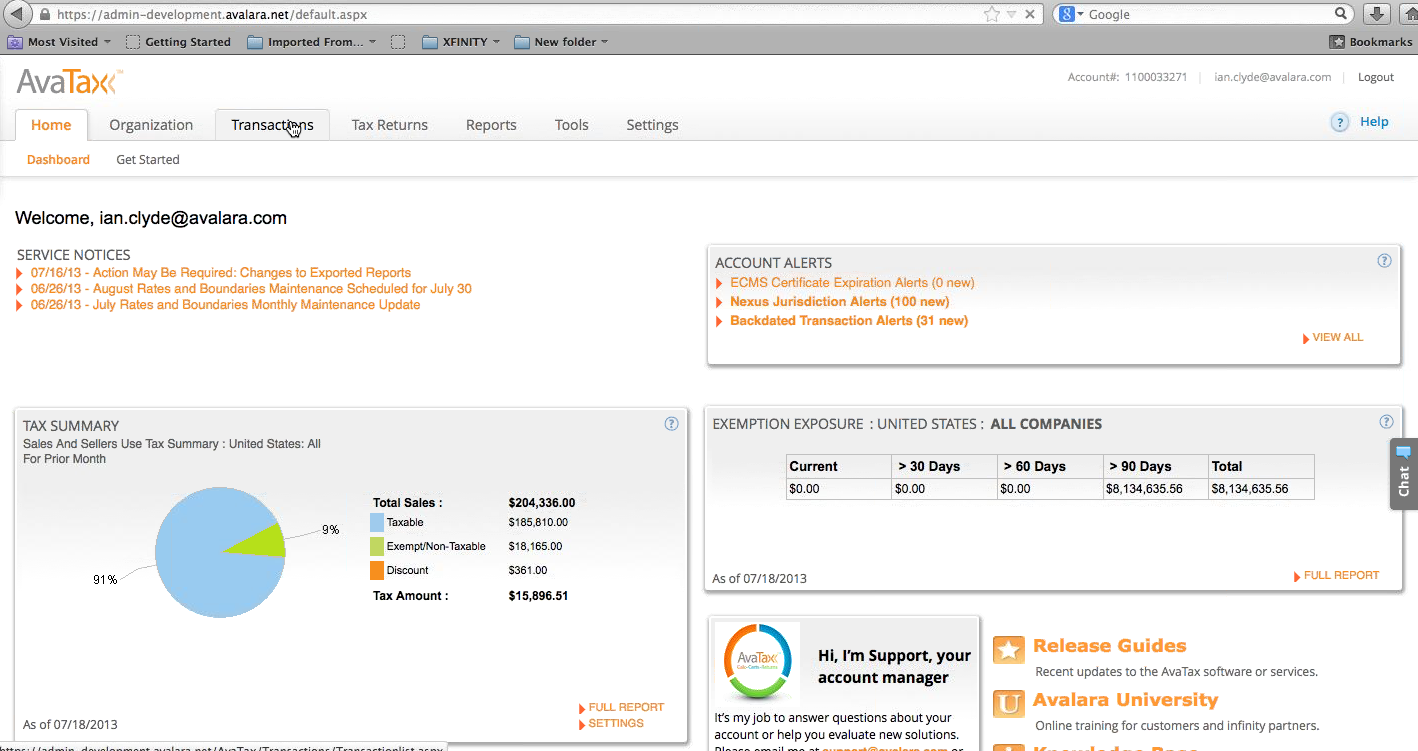

Avalara Avatax Sales Tax Automation Product Evaluation Business 2 Community

Understanding The Avatax For Communications Tax Engine Avalara Help Center